|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

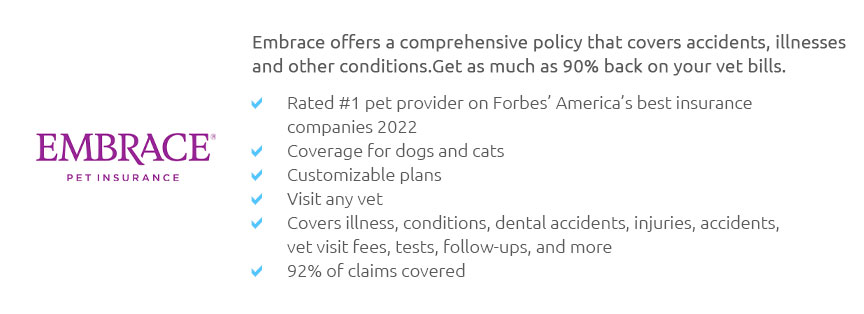

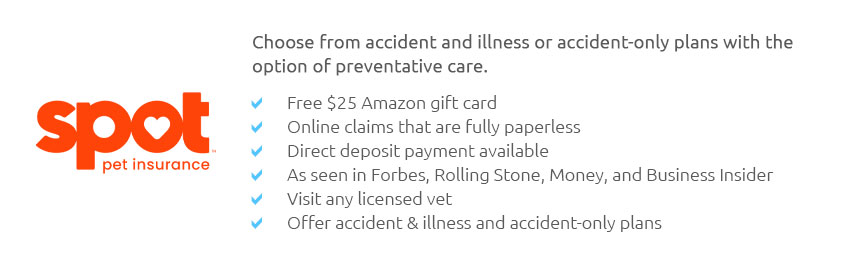

Pitbull Dog Insurance: Understanding the EssentialsPitbulls, with their strong build and often misunderstood reputation, are a breed that captures the hearts of many. Yet, owning a pitbull can come with its own set of unique challenges, particularly when it comes to securing insurance. This comprehensive article delves into the world of pitbull dog insurance, unraveling the intricacies involved and offering insights into how it works. One might wonder, why is there even a need for specific insurance for pitbulls? The answer lies in a combination of factors that include the breed's history, public perception, and incidents of aggression-whether perceived or actual. These factors often lead to a heightened risk in the eyes of insurers, making it imperative for owners to seek out specialized coverage. Insurance Policies for pitbulls typically offer coverage that ranges from liability protection to medical expenses. Liability coverage is particularly crucial, as it protects the owner in the unfortunate event of an incident where the dog causes injury to a person or damage to property. Given the legal and financial ramifications that could arise from such situations, this type of insurance is not just a safeguard-it's a necessity. Medical insurance, on the other hand, ensures that your pitbull receives the healthcare it needs without the burden of exorbitant veterinary bills. From routine check-ups to emergency surgeries, having comprehensive medical coverage can make a significant difference in the quality of care your pet receives. Yet, finding the right insurance policy is not always straightforward. Many mainstream insurance companies are hesitant to cover pitbulls, often due to their classification as a 'high-risk' breed. However, there are specialized insurers that cater specifically to owners of pitbulls and other breeds deemed high-risk. These companies understand the nuances of insuring such breeds and offer tailored policies that address the specific needs and concerns of pitbull owners. When considering insurance, it's essential to thoroughly research and compare different policies. Look for insurers that provide clear terms and conditions, and ensure that there are no hidden clauses that could lead to complications down the line. It's also wise to read reviews and seek recommendations from other pitbull owners who have navigated the insurance landscape successfully. Tips for Lowering Insurance Costs can also be beneficial. Consider investing in obedience training for your pitbull, as a well-behaved dog is less likely to be involved in incidents that could lead to claims. Additionally, maintaining a safe and secure environment, such as a fenced yard, can help demonstrate to insurers that you are a responsible owner, potentially lowering your premiums. Ultimately, owning a pitbull is about embracing the breed's unique characteristics while taking responsible measures to protect both your pet and yourself. Insurance is a vital component of this responsibility, providing peace of mind and a safety net for any unforeseen circumstances. FAQ Section Why is pitbull dog insurance more expensive than for other breeds? Pitbull insurance can be more expensive due to the breed's reputation and classification as high-risk, leading insurers to anticipate higher potential claims. What types of coverage should I look for in a pitbull insurance policy? Look for liability coverage to protect against third-party claims, as well as medical insurance to cover veterinary expenses. Are there any ways to reduce the cost of pitbull insurance? Yes, training your pitbull and demonstrating responsible ownership, such as having a secure yard, can help lower insurance costs. How can I find insurers that cover pitbulls? Research specialized insurance companies that focus on high-risk breeds, and seek recommendations from other pitbull owners. What should I avoid when choosing a pitbull insurance policy? Avoid policies with unclear terms or hidden clauses that might complicate claims; always read the fine print. https://www.prudentpet.com/dog-insurance/dog-breeds/pit-bull/

Pitties are sometimes seen as mean dogs but they couldn't be more wrong! Their cute puppy dog eyes are loved by all alike and we love them ... https://www.nerdwallet.com/article/insurance/home-insurance-pit-bull

If you can't find a willing home insurer, look into a canine liability policy. This type of insurance offers stand-alone coverage geared toward ... https://www.pawlicy.com/dog-insurance/american-pit-bull-terrier-pet-insurance/

How much is pet insurance for a American Pit Bull Terrier puppy? ; New York City, NY. 6 Months Old - $54 to $90. 5 Years Old - $72 to $109 ; Thomasville, AL. 6 ...

|