|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

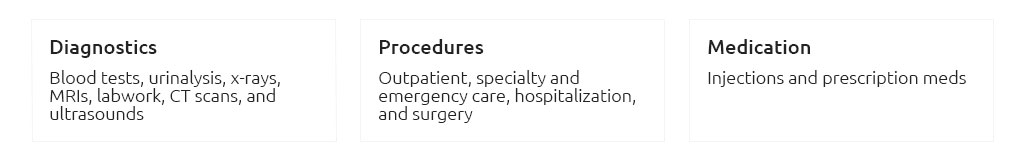

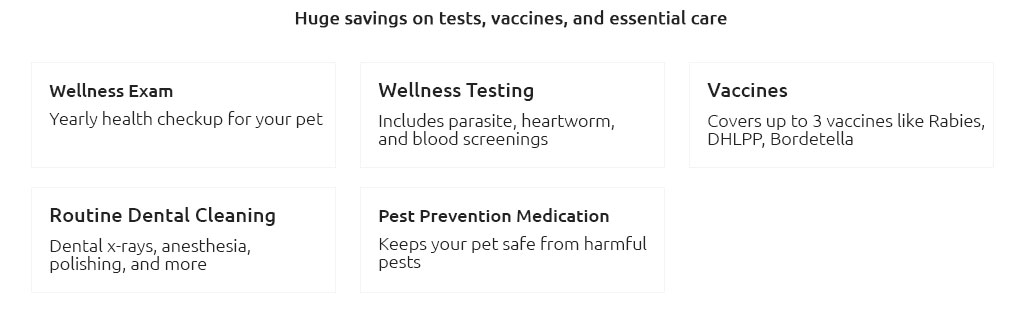

pitbull dog insurance made simple for long-term peaceThe decision that lastsProtecting a powerful, affectionate dog is less about fear and more about predictability. Insurance turns sharp, unexpected costs into a steady, known number. That is the whole point: simple inputs, calmer outcomes, year after year. What coverage actually matters

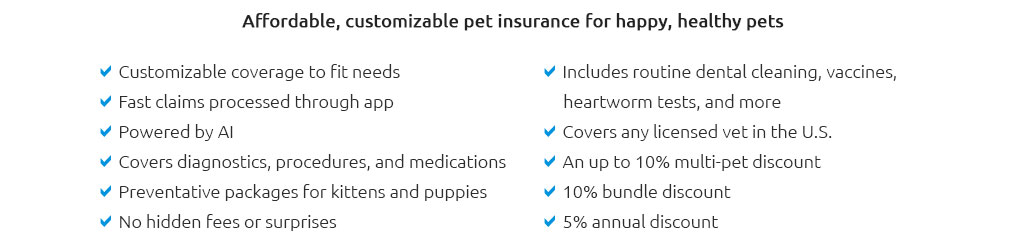

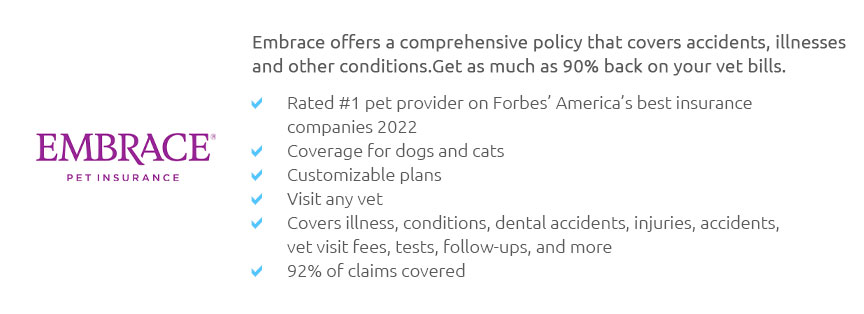

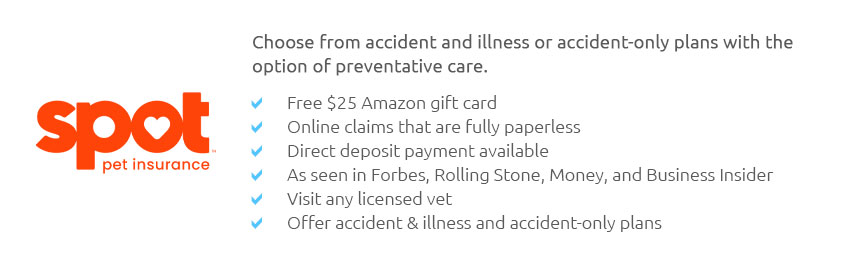

Costs, tamedPrice shifts with age, ZIP code, deductible, reimbursement, and annual limit. I keep it stable by choosing a middle path: moderate deductible, ~80% reimbursement, a limit high enough to absorb surgery but not unlimited by default.

Breed rules: reality checkSome carriers restrict pit bull - type dogs or exclude liability claims involving them. Read the declarations page and the exclusions section slowly. We pause - nothing urgent - just noticing what matters. A real momentLast spring, I added a small liability rider after my landlord updated the lease for dog breeds named in their list. It cost a few dollars a month and the approval came through the same afternoon. Quiet win. Choose in 15 minutes

Claims without frictionSave digital vet invoices, vaccination records, and photos. Add training certificates if you have them; they can support behavioral claims or landlord requests. File promptly; attach clear notes; keep it boring and documented. Long-term viewAcross a dog's life, premiums rise; health needs change; moves happen. The winning strategy is durable simplicity: one policy you understand, reviewed annually, adjusted gently, kept for the full journey. Quick checklist

Common myths, quietly retired

Final wordPick a plan you can keep, confirm liability terms for your dog, and document everything. Review once a year, then move on with your life. Simple choices now, fewer surprises later.

|